-

info@wiseraccounting.com

-

Inquire about Tax Services: 403-970-1402

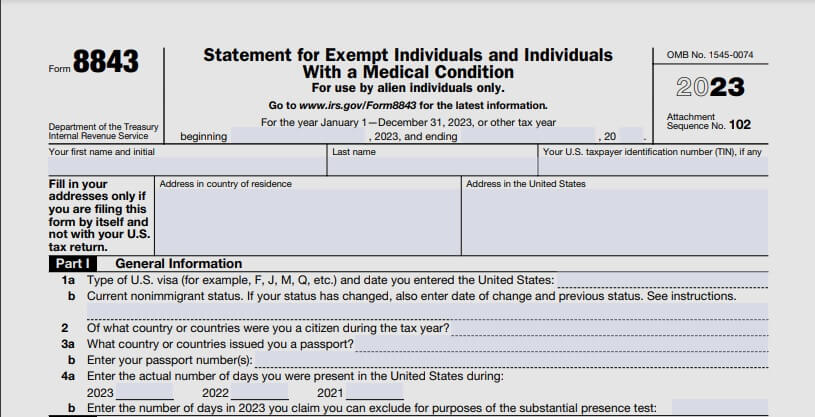

If you are an alien individual, file Form 8843 to explain the basis of your claim that you can exclude days present in the United States for purposes of the substantial presence test because you:

Form 8843 is not an income tax return.

Instead, it is a statement you file for the US Government if you are a certain type of nonresident alien for tax purposes (including spouses and dependents of certain nonresident aliens).

All nonresidents aliens who are in the US on F-1, J-1, F-2 or J-2 visas are required to file a Form 8843. Even if you earned no US income, you must still file this form.

You must file a Form 8843 if:

Even if you don’t need to file an income tax return, you should file the Form 8843 if the above criteria apply.

Part 1 of form 8843 – General Information:

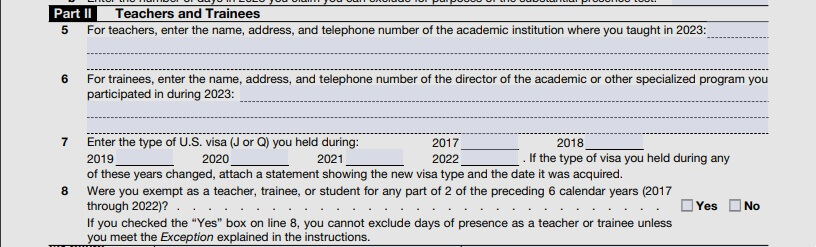

Part 2 of form 8843 – Teachers and Trainees

Teachers and trainees are required to include details of what academic institution or program you were involved in during the previous year.

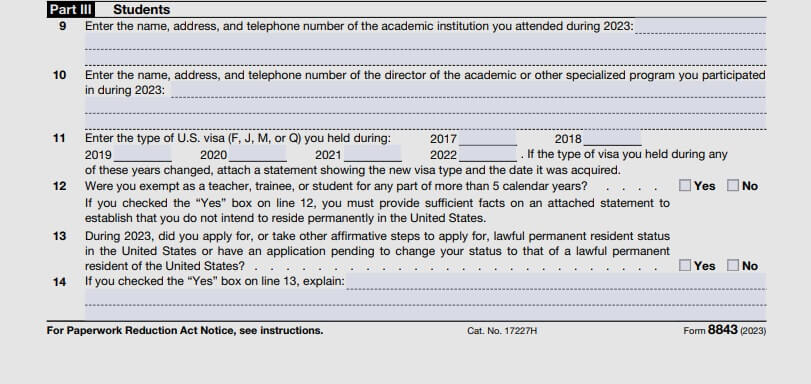

Part 3 of form 8843 – Students

If you are an F-1 international student or J-1 visa holder (and dependent), in part 3 you should include details of your academic institution or program and answer the rest of the questions according to your personal circumstances.

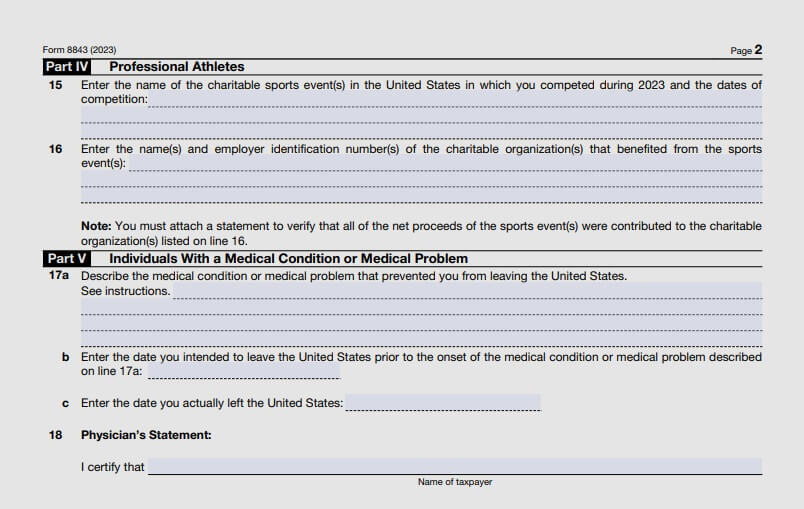

Part 4 (Professional Athletes) and 5 (Individuals with a Medical Condition or Medical Problem)

The majority of students in the US on F or J non-immigrant status will not need to fill in parts 4 and 5.

Form 8843 is typically attached to your 1040-NR income tax return.

If you’re filing form 1040-NR, you should mail form 8843 to the address shown in your tax return instructions.

However, if you have no income and are only filing Form 8843, you should print Form 8843 and mail it to:

Department of the Treasury,

Internal Revenue Service Center

Center, Austin, TX 73301-0215

The 2024 deadline for filing Form 8843, along with any tax return that is due, is 15 April 2024.

By not filing on time, you may not exclude the days you were present in the United States, which could result in you being considered a US resident under the substantial presence test.

Howver, the IRS does allow nonresidents in the US to file 8843 for previous years they have missed. To do this, you will simply need to attach a Form 8843 for each year you were present in the US with your tax return.