-

info@wiseraccounting.com

-

Inquire about Tax Services: 403-970-1402

If you do not pay US taxes, you may be wondering why you are asked to fill out an Internal Revenue Service (IRS) W-8BEN form. The W-8BEN is an important form for any non-US taxpayer who has earned interest in the US over a calendar year.

W-8 Forms

W-8 forms are Internal Revenue Service (IRS) forms that foreign individuals and businesses must file to verify their country of residence for tax purposes, certifying that they qualify for a lower rate of tax withholding.

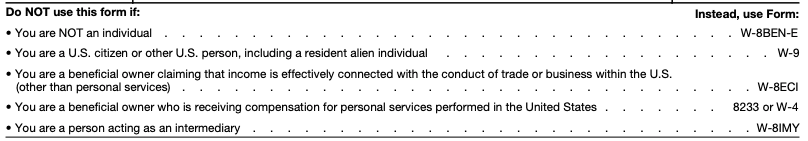

W-8 forms are used by foreign persons or business entities to claim exempt status from certain withholdings. There are five W-8 forms: W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, and W-8IMY.

Although the W-8 forms are issued by the IRS, they are submitted only to payers or withholding agents, not to the IRS.

Form W8-BEN, Certificate of Foreign Status of Beneficial Owner for U.S. Tax Withholding, is used by a foreign person to establish both foreign status and beneficial ownership, and to claim income tax treaty benefits with respect to income other than compensation for personal services. Essentially, this form helps prevent double taxation and ensures the proper application of tax treaty benefits or exemptions for foreign individuals. A U.S. employer should request a W-8BEN from non-U.S. citizen employees or international contractors.

Why is W-8BEN important?

By providing a completed Form W-8BEN, you are confirming that:

Failure to submit the form may result in a withholding at the full 30% rate that applies to foreign individuals.

Who should fill out a Form W8-BEN?

The W8-BEN is to be completed by a nonresident alien who has received income that would normally be subject to United States tax withholdings. It should be completed by the foreign worker/contractor, not by the American business or employer. Foreign entities or those acting as an intermediary should not complete this form.

How to fill out the W-8 BEN?

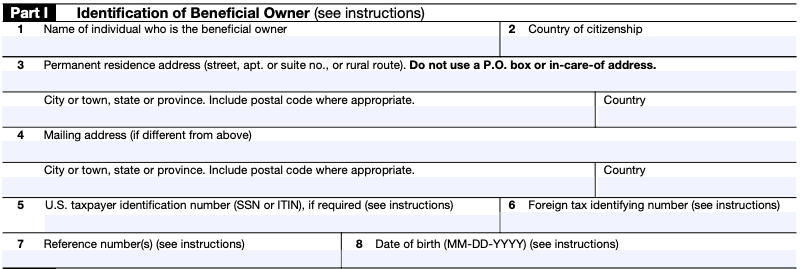

Part I

Line 1 of the form asks for the name of the beneficial owner. This should be the name of the person who is filling out the form: this is the foreign worker who has received payment from an American payer.

Line 2 asks for the country of citizenship. The W8-BEN is typically to be filled out only by an individual who is not a U.S. citizen or resident.

Line 3 is the permanent residence address including city, town, state, providence, postal code and country. The person filling out the form should not use a PO Box, financial institution, or care of address.

Line 4 is for the mailing address. This section should only be completed if the mailing address is different from the permanent residence address listed above.

Line 5 requests the U.S. taxpayer identification number, which could be a social security number or an individual tax identification number if the contractor is a resident alien. An SSN or TIN must be provided if the contractor is claiming treaty benefits and/or a reduced withholding rate.

Line 6 requests a foreign tax identifying number (social insurance number for Canadians).

Line 7 is requesting a reference number for the withholding agent. The contractor may include the number of the account to which payments are being made. In some cases this line will be filed ot by the withholding agent to reference an account or form that should be associated with this W8-BEN.

Line 8 asks for the date of birth of the contractor.

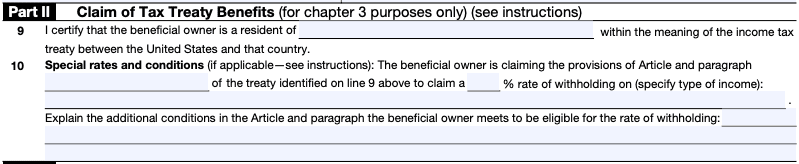

Part II

This section should only be completed if the contractor is claiming treaty benefits as a resident of a foreign country with which the U.S. has an income tax treaty under Chapter 3 regarding withholding of tax on non-resident aliens and foreign corporations.

Line 9 certifies that the country in which the contractor is a resident has a tax treaty with the United States.

Line 10 is only used to provide special rates or conditions for withholding tax between the U.S. and the resident country, along with a blank line to add any additional comments or explanations of eligibility for the special rate.

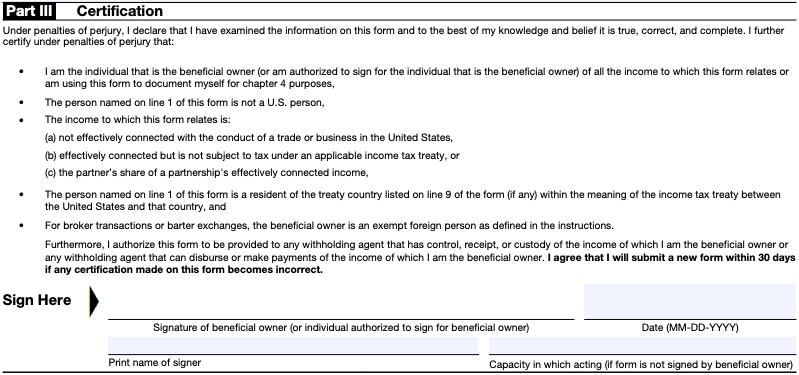

Part III

This is the section where the foreign contractor signs and certifies that they are in fact not a U.S. person, and the income to which this form relates was not earned or connected to a business that is located or conducted in the United States. It certifies that said income should not be subject to withholding tax or taxed at a special rate and that the contractor agrees to submit a new form within 30 days if any information on the document becomes incorrect.

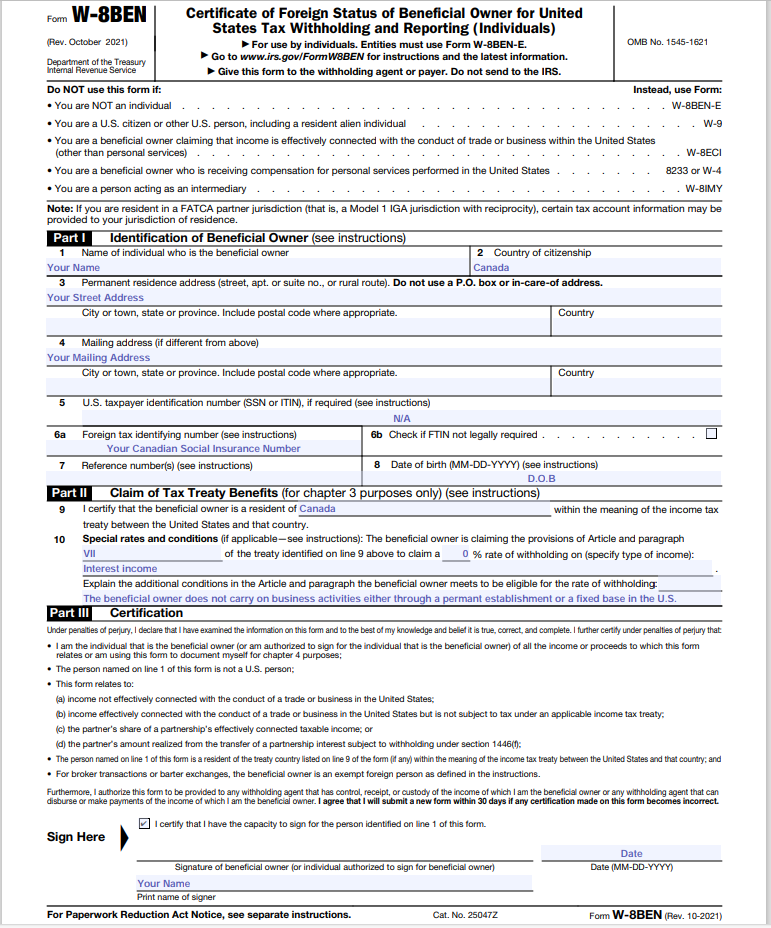

Sample W8-BEN for Canadians

Here is a sample W8-BEN form for Canadian residents:

When and where to submit W-8 forms

Technically, you do not file W-8 forms with the IRS.

Form W-8BEN will be sent by the organization that is making payments to you.

It should then be returned to the company that sent it to you, not the IRS. You won’t need to file it with a tax return.

Form W-8BEN will remain valid for at least three calendar years. A Form W-8BEN expires on the third complete calendar year after it is signed. For example, if you sign a W-8BEN on July 28, 2021, it will expire on December 31, 2025. You need to file a new W-8BEN sooner for changes in circumstances causing information on a submitted W-8 BEN to be incorrect.

According to the IRS Instructions for Form W-8BEN, “you must notify the withholding agent, payer, or FFI with which you hold an account within 30 days of the change in circumstances and you must file a new Form W-8BEN or other appropriate form.”